In recent years, China's IVD industry has grown rapidly at an annual growth rate of over 15%. In 2018, the market capacity of in vitro diagnostic products in China reached 70 billion yuan, becoming the fastest-growing sub market in the entire medical device industry. However, based on the national per capita calculation, the annual expenditure on in vitro diagnostics in China is only about $5 per person, far below the average level of $25-30 in developed countries, and is still in the development stage of the industry lifecycle. With people's increasing attention to the health industry, the aging population process, and the support of relevant policies for the medical industry by the government, the construction of Healthy China is continuously advancing. It is expected that in the next five years or even longer, China's IVD industry will still be in a golden period of rapid development.

In vitro diagnosis only consumes 3% of medical resources, but provides over 70% of clinical diagnosis information, known as the "eyes" of doctors. Since the trade friction between China and the United States this year, the communication industry, led by ZTE and Huawei, has been the hardest hit and has been greatly affected.

These lessons from the past have also prompted many practitioners in the in vitro diagnostic industry to think about a question: what kind of pressure will our in vitro diagnostic industry face if developed countries suddenly stop supplying upstream raw materials and key components related to the lifeline of in vitro diagnostics?!

In vitro diagnostic systems are mainly composed of diagnostic instruments and reagents. However, both diagnostic instruments and reagents face a bottleneck situation similar to the communication industry, where core components and raw materials heavily rely on imports. The upstream raw material market capacity of in vitro diagnostic reagents in China is expected to reach 6 billion yuan, and with the addition of key components (components) of in vitro diagnostic instruments, the overall market capacity will reach over 10 billion yuan. However, the situation of heavy reliance on imports is very serious.

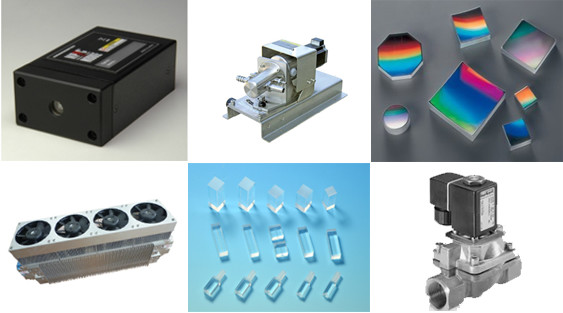

For common in vitro diagnostic instruments, the core components that mainly rely on imports include:

(1) Single photon counting module

The single photon counting module is the core and key component of chemiluminescence immunoassay, used to count the weak photons produced by chemiluminescence reagents. Currently, the annual consumption in China is about 10000, with a unit price ranging from 6000 to 10000 yuan per unit. At present, only Shenzhen New Industry Biotechnology and Shenzhen Mindray Company in China purchase photomultiplier tubes (priced at about 2000-2500 yuan/unit), and develop their own circuits to form single photon counting modules. Other companies need to purchase from outside, and the market is almost completely monopolized by Japanese Hamamatsu Company.

(2) Concave flat image field grating

The concave flat image field grating is the core and key component of a high-end fully automatic biochemical analyzer, used for the generation of monochromatic light in the backscatter. At present, domestic manufacturers of high-end fully automatic biochemical analyzers (Shenzhen Mindray, Changchun Dirui, Shenzhen New Industry) all use Japanese Shimadzu's concave flat field grating. Ningbo Yuanlv Optoelectronics Co., Ltd. in China has also achieved the production of concave flat image field gratings, but due to price and quality reasons, it has not been recognized by major domestic manufacturers of biochemical analyzers.

(3) Laser

Laser is an important key component of flow cytometers, flow cytometry particle fluorescence analyzers, digital PCR, and high-end five classification blood analyzers. It is used to generate a stable and narrow light source for irradiation or excitation of the detection object, thereby forming a detection signal. At present, high-end flow cytometers and other instruments use Coherent products from the United States, with prices ranging from 30000 to 40000 yuan per unit. Suzhou Weilin Optoelectronics Co., Ltd. in China has been able to produce high-performance lasers at a price of about 20000 yuan per unit, which is only about half of the imported products and has been used by some domestic manufacturers.

(4) Sampling needle

The sampling needle is an important key component of high-end fully automatic biochemical analyzers and fully automatic chemiluminescence immunoassay analyzers, used to extract trace amounts of samples (at least 1ul) into the reaction cup. The sampling needle is a key component of a series of equipment, and its quality directly affects the overall performance indicators of the instrument. At present, all the sampling needles for domestically produced high-end biochemical analyzers and chemiluminescence analyzers rely on imports. The main import suppliers for sampling needles include Ito Manufacturing Co., Ltd. in Japan, Takasa Corporation in Japan, and UNIMED in Switzerland. Shenzhen Wanchen Technology and Shenzhen Zhongke Konsenruit are also making sampling needles, but due to performance reasons, they have not yet been applied in domestic high-end instruments.

(5) Plunger pump

The plunger pump is a key component of in vitro diagnostic instruments such as fully automatic biochemical analyzers and fully automatic chemiluminescence immunoassay analyzers, mainly used for extracting samples and reagents. At present, high-end in vitro diagnostic products in China all use plunger pumps from IDEX Company in the United States, with prices ranging from 1500 to 2000 per unit. In recent years, Shenzhen Kentuo, Shenzhen Hengyongda, and Dongguan Jurui have all developed and produced high-performance plunger pumps, which have been applied in some products of well-known domestic extracorporeal companies.

(6) Valveless plunger pump

The valve free plunger pump is an important key component of the fully automatic chemiluminescence immunoassay analyzer, mainly used to pump the excited substrate into the reaction cup. The main manufacturer of valve less plunger pumps is IWAKI from Japan, with a price of around 2000 yuan per unit. Last year, Dongguan Xinnong Company developed a valve free plunger pump and tested it in some companies' products, but it has not been widely used yet.

(7) Electromagnetic valve

Electromagnetic valve is a key component of fully automatic biochemical analyzer, fully automatic chemiluminescence immunoassay analyzer, and five classification blood analyzer. It is mainly used for liquid flow switching and on/off, and its performance directly affects the overall performance of the machine. At present, the electromagnetic valves of high-end products are mainly imported brands, including German Baodi and Japanese SMC, with prices ranging from 500 to 1000 per piece. Shenzhen Kentuo has made rapid progress in recent years, and the electromagnetic valves developed and mass-produced have been widely used in many domestic in vitro diagnostic companies.

(8) Sheath flow pool

The sheath flow pool is a key component of the fully automatic five classification blood cell analyzer, flow cytometer, and flow cytometry particle fluorescence analyzer. It is mainly used for generating sheath flow and detection areas, with an annual demand of approximately 40000 to 50000 units. At present, we mainly rely on imported supplies such as Hellma from Germany and Japan cells from Japan. At present, optical device processing companies in China have successively invested in the research and development of flow chamber products. Among them, Fuzhou Gaoyi Technology and Fuzhou Rongde Optoelectronics Technology have achieved mass production. The former has exclusive cooperation with Mindray Company for development and is generally not sold to other domestic blood cell meter manufacturers; However, Fuzhou Rongde Optoelectronics has only seen products appear in the past two years, and the manufacturers are still in the stage of sample verification and have not used them in bulk. Due to the fact that the process technology of the flow chamber involves about dozens of processes from quartz glass blanks to finished products, most key processes rely on skilled technicians, resulting in poor process stability and high defect rates. At present, the accuracy of domestic products is not as good as that of imported flow chambers, which makes them generally only used in low-end five classification blood cell analyzers and cannot be used in high-end products with higher requirements.

Compared to diagnostic equipment, the dependence of core raw materials in in vitro diagnostic reagents on imports is greater:

(1) Antigens and antibodies

Mainly used for various immune diagnoses, it is one of the most important in vitro diagnostic materials, widely used in enzyme-linked immunosorbent assay, chemiluminescence immunoassay, colloidal gold lateral chromatography, fluorescence immunoassay lateral chromatography and other detection platforms. Currently, the domestic market capacity has approached 3 billion. International advanced enterprises in antigen and antibody include Hytest, Medix, Meridian, etc. Domestic innovation and entrepreneurship are extremely active in this field, and the gap between many new projects and foreign countries is becoming smaller. However, it should also be noted that core raw materials for major categories such as autoimmune and hypertension are still unable to be produced independently in China, and the quality of some monoclonal antibodies (such as HbA1c, d-dimer, CKMM, etc.) with a market value of over 100 million yuan still cannot meet the needs of clinical applications, almost all of which rely on imports.

(2) Enzymes/Coenzymes/Enzyme Substrates

Widely used in almost all in vitro diagnostic sub fields such as biochemistry, immunity, molecules, POCT, coagulation, and blood sugar, it is the most widely used core biological raw material. Currently, the domestic enzyme/coenzyme/enzyme substrate market is about 2 billion, mainly led by imported brands such as Roche and Dongyang Textile. The technical threshold for enzyme related products is high, the market is relatively fragmented, and the development of various sub sectors in China is uneven. Domestic enterprises still have weak strength in the field of RT-PCR molecular diagnosis, coagulation, blood sugar, and other in vitro diagnostic fields that heavily use enzymes. Some basic raw materials, such as horseradish peroxidase and ascorbic acid oxidase, heavily rely on imports for a wide range of basic products, resulting in a severe bottleneck phenomenon.

(3) Magnetic particles/microspheres/NC films

It is a key material and reaction carrier for processes such as magnetic particle chemiluminescence, latex immunoturbidity, immunofluorescence, liquid phase chips, and nucleic acid extraction. At present, the domestic magnetic bead market is about 200 million, latex microspheres are about 100 million, and NC films are about 200 million. Almost all mainstream domestic manufacturers of these products adopt imported products such as Merck, GE, Thermo Fisher, and JSR. In recent years, some teams in China have made considerable core technology reserves, but they have not yet formed large-scale sales. The stability of their production processes and brand influence still need to be tested, and the overall localization rate is still very low.

Reagent raw materials and equipment components play an important strategic role in the entire in vitro diagnostic industry chain.

They are the source of innovation in in in vitro diagnostic technology, and innovation in downstream clinical application technology often requires support from the raw material level. Therefore, in order to master the most advanced diagnostic technology, it is often necessary to first master the most advanced raw material technology; Secondly, these core materials have a significant impact on the performance of diagnostic systems. The performance limit of core materials largely determines the upper limit of in vitro diagnostic system performance. To develop the most powerful diagnostic technology, high-end materials are often needed to support it. At present, China's core raw material industry heavily relies on imports, and foreign manufacturers are in a monopolistic position, leading to high costs and seriously affecting the international competitiveness of Chinese enterprises. Moreover, in the context of the trade war, the continuous and smooth supply of a large number of imported core raw materials is difficult to fully guarantee, seriously affecting the industrial security of the entire in vitro diagnostic industry. Taking only horseradish peroxidase as an example, the market value of this enzyme preparation is only tens of millions of yuan, but it supports nearly half of the biochemical diagnostic reagents, most enzyme-linked immunosorbent assay reagents, and a considerable portion of magnetic particle chemiluminescence reagents. Once the import supply of this single raw material is unstable, it will directly lead to significant fluctuations in the domestic in vitro diagnostic industry, causing great impact on the downstream medical inspection and even the entire medical industry, which amounts to trillions of yuan. In 2017, Roche Diagnostics Life Sciences Department's raw materials department had a global sales revenue of nearly 265 million Swiss francs, equivalent to approximately 1.7 billion RMB. Biochemical and immunological raw materials accounted for more than 50%, while molecular diagnostic materials accounted for about 30%. Roche Diagnostics is also one of the early international companies to enter the Chinese market. According to statistics, Roche's sales of IVD raw materials in China exceeded 200 million yuan in 2017, making it the largest market share and market leader in China's diagnostic reagent biochemical enzyme raw materials market. In 2017, the global sales of Dongyang Textile Health and Medical Department reached nearly 35.7 billion yen, equivalent to approximately 2 billion yuan. Dongyang Textile's products in the Chinese IVD market are mainly biochemical raw materials and large packaging reagents, and it is also actively expanding into the molecular diagnostic raw material market. In 2017, the overall raw material sales were nearly 200 million yuan. BBI Company's global sales in 2017 were nearly 460 million RMB, with sales of protein and antibody related products reaching nearly 47 million RMB, a growth rate of 36.2%. The gross profit margin of this business is 41.6%. In 2016, the global sales of Medea Life Sciences reached nearly 50 million US dollars, with the Chinese market contributing over 4 million US dollars, an increase of 62%. The high growth rate of the Chinese market is also a key factor for Medea's future development.

The active production and research and development enterprises in the upstream of localized biological raw materials in China, including Hanhai New Enzyme, Feipeng Biology, Lanyuan Biology, Apis, Novozan, Beaver Biology, Baichuan Feihong, HaiPeptide Biology, Huamei Biology, Zhongmei Xinxin, Tansheng Biology, Putai Biology, Weidu Biology, Yingruicheng, Zhuhai Bomei, Aibosheng, Boasen, Longji Biology, Keyue Zhongkai, Aochuang Biology, Jiannaixi, Shanghai Leading Tide, Xianzhi Biology, Nearshore Technology, Solelbao, Wankelong, Greelin, etc., have also shown good market performance.

The upstream key raw material industry in China has made significant progress in recent years, but there are still significant development bottlenecks as follows:

1) Late start and weak foundation: The formation of the domestic in vitro diagnostic industry has only been 20 years, and its development has been particularly rapid in the past decade. However, key raw materials and key components are mostly selected from foreign brands. Domestic key raw materials and key components have followed the development of the domestic in vitro diagnostic industry, with a certain degree of lag. Moreover, the key raw materials belong to the upstream of the entire in vitro diagnostic industry, and the market space is small. Therefore, individuals are mainly entering this field, and the company size is generally not large, with weak research and development capabilities, low product quality, and poor process stability. These are all necessary processes for the development of the industry from small to large, and they are also the current situation that needs to be addressed;

2) Weak brand and difficult market promotion: Downstream manufacturers of in vitro diagnostics usually choose imported key raw materials and components during the research and development stage to ensure product quality. In addition, the gross profit margin of in vitro diagnostic reagents is relatively high, so downstream production enterprises choose domestic raw materials and components with low motivation. For products that have already been developed, if key raw materials and components need to be changed, they need to be re registered or inspected according to the current medical device management regulations. Therefore, only when there is significant cost pressure, downstream manufacturers are willing to choose domestic key raw materials and components, further resulting in higher costs of domestic substitution. In addition, most domestic manufacturers of in vitro diagnostic reagents or instruments discriminate against domestic raw materials, leading to a disadvantaged position for raw material manufacturers. Even when the product quality is up to standard, they often face excessive price demands from customers, making it difficult to obtain reasonable profits for further development and growth.

The core raw material industry of in vitro diagnosis is a strategic field that drives the whole body. Whoever can achieve development or layout in this field as early as possible will be the main carrier of future in vitro diagnosis development. The development and progress of this field not only ensure the strategic safety of in vitro diagnosis product production and research and development, but also effectively solve the problem of being controlled by others and ensuring product safety in production. Facing these issues seriously, how to ensure the safety of in vitro diagnostic production in our country, and in the event of unexpected constraints, we need to have a good "spare tire" plan, which requires us to have good suggestions and in-depth thinking. For localized upstream raw material production enterprises in China, it is necessary to carry out more systematic and rigorous effective quality control. From raw materials to final production purification and processes, strict control must be exercised to provide solid support for the production of in vitro diagnostic reagents and instruments, and jointly promote the development of China's in vitro diagnostic industry on a healthier path.

Therefore, it is necessary for localized raw material suppliers to further enhance their innovation capabilities and product quality, continuously enhance their core competitiveness, which is the foundation for achieving long-term development;

Secondly, downstream manufacturers of in vitro diagnostic reagents and instruments need to change their mindset. They must understand that product quality is improved through iteration, and any product is discovered and solved during use. Through continuous problem-solving, the quality of the product can be continuously improved. If domestic downstream manufacturers do not use domestic raw materials and components, our country's in vitro diagnostic industry will always be worried about being "choked" by foreign countries;

Furthermore, our capital and production enterprises should attach importance to and pay attention to upstream raw material production enterprises, and increase investment in this field. This is just like how our country's laboratory does not use domestically produced in vitro diagnostic products, it is impossible to achieve the development of our domestically produced in vitro diagnostic industry. In addition, downstream manufacturers should not blindly believe that domestically produced products should be much cheaper than imported ones. If they are not much cheaper than imported ones, they should not use domestically produced products. Any high-quality product must require high investment in research and development, and relying on low prices is difficult to promote the improvement of high-quality products. Concepts should not only be viewed from the economic perspective of the enterprise itself, but should also be strategically positioned from the perspective of the entire industry and the long-term development of the enterprise. In order to promote the development of key raw materials and components, downstream production enterprises can appropriately participate in the research and development and production companies of upstream key raw materials and components, form strategic partners for win-win cooperation, and thereby promote the production and research and development of upstream key raw materials.

Marx told us a truth over 100 years ago, "There has never been a savior, nor a divine emperor.". Therefore, we have the responsibility and obligation to care for and support the production, research and development, and sales enterprises of our localized upstream raw materials, and to help our localized upstream raw material production, research and development, and operation enterprises continuously improve their quality and scale from a higher perspective and requirements, of course, regarding human health